If you haven’t seen the official US inflation numbers for the past six months, you’ve most likely felt them in any number of ways: the grocery store, the gas pump or maybe in your practice via wages (especially with new hires), and increased marketing costs.

If you haven’t seen the official US inflation numbers for the past six months, you’ve most likely felt them in any number of ways: the grocery store, the gas pump or maybe in your practice via wages (especially with new hires), and increased marketing costs.

So, yes, inflation is here. It’s at the highest level in 13 years and rising at the fastest pace in 30 years.

So, the big question is: what should you, the private dental practice owner, be doing about it?

I’m going to start with statistics. And I promise to make this brief and non-boring! Now, before I get to the “what to do about it” section, I have to provide some statistical information to frame what you’re up against!

Current Inflationary Trends:

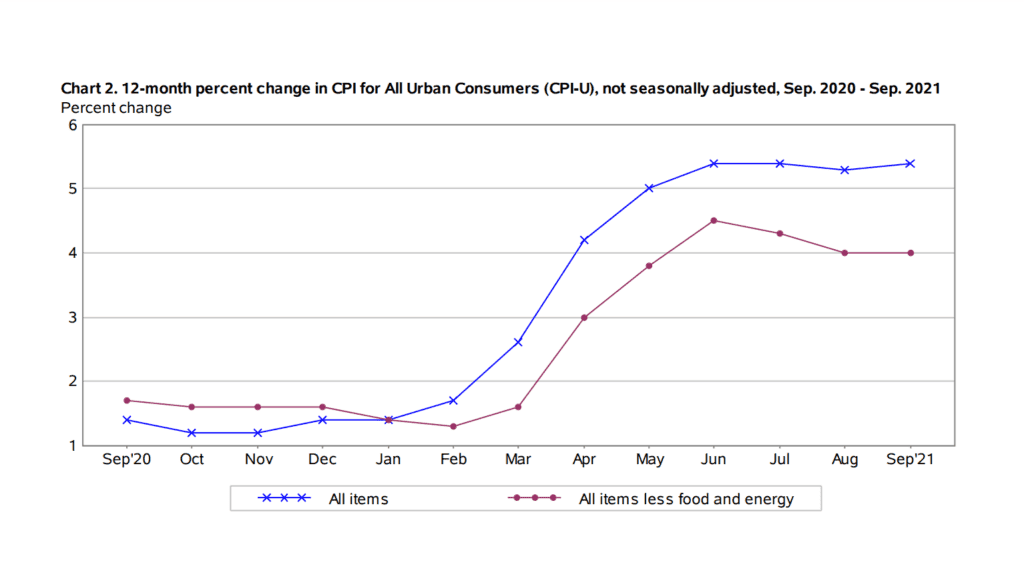

The year over year inflation percentage for September of 2021 was 5.4%. This percentage is calculated off of the “Consumer Price Index” or “CPI,” which you’ve probably heard of before. The CPI is simply a measurement of a fixed “basket” of goods and services (e.g. food, gas, auto expenses, medical care, rent, etc.) and its price increase or decrease over time.

So, in September of 2021, the average increase in prices from September of 2020 was 5.4%. So, on average, what cost you $100 in September of 2020 would cost you $105.40 in September of 2021.

Now, this is an average – so some goods and services have gone up more than 5.4% and some less. For example, energy costs (fuel, gas, and electric costs) have gone up by 24.8% and clothes (apparel) by 3.4%.

Nonetheless, a 5.4% increase is a BIG deal. For reference, check out this graph.

Inflation begins spiking in March of 2021, and jumps to over 5% in May and hasn’t let up since. (https://www.bls.gov/cpi/)

Inflation begins spiking in March of 2021, and jumps to over 5% in May and hasn’t let up since. (https://www.bls.gov/cpi/)

So, costs are going up, and your dollars are losing purchasing power. Let’s have a look at how this affects your office.

The Costs of Running a Private Dental Practice

To run profitably, a dental practice needs to keep its expense “categories” at or below a set percentage of revenues.

Here’s an example for a solo dentist:

| Rent and Mortgage Expense | 4-5% |

| Loans and Lines of Credit | ** |

| Lease Expenses | ** |

| Credit Cards | ** |

| Insurance (Does not include disability or life) | 2.0% |

| Outside Services (accountant, etc.) | 1.7% |

| Utilities | .6% |

| Communication & Phone | .6% |

| Dues & Licensing | ** |

| Subscriptions | ** |

| Payroll Expense (Includes Taxes) | 22.5% |

| Advertising | 4-6% |

| Continuing Education | 1-5% |

| Office Expense (business office supplies, postage, etc.) | 1.3% |

| Dental Supplies | 6-7% |

| Lab Expenses | 6-9% |

| TOTAL | 50-61% |

| GROSS PROFIT | 50-39% |

** = no set percentage for these categories. A newer practice will have higher debt (hence higher costs to service debt), versus an established office.

Now, obviously, these percentages are a suggestion. You may run at a lower amount in certain categories and if you do – great! But you don’t want to run any higher. The only exception I’d make would be marketing. Your marketing expense should be based on how aggressively you want to grow. If you’re hitting it hard, this might go up to 10% or more (especially with a newer office). I’d of course expect to see these increased marketing costs result in raised revenues. For more on overhead, check out our blog series on managing your overhead and profitability.

Anyway, don’t want to go off track on an overhead diatribe. I put this up to demonstrate a point. Let’s take the category of Payroll Expense:

In our guidelines above, we have payroll expenses for ALL staff (except the owner/doctor, and any associates) set at a maximum of 22.5%. And while this does not include associates or the owner/doctor, it DOES include hygienists, office managers, EFDAs, etc. This 22.5% DOES include employer payroll taxes. (note: these are US numbers, for our Canadian clients, the percentage is 20.9% NOT including payroll taxes).

Alright, so 22.5%. Sounds good. But keep in mind it’s costing your employees more to get to work (gas) these days and eat, you may have considered a raise of some sort. You may also have been in hiring mode. Well, you’ve most likely noticed that new applicants are asking for a whole lot more than they used to!

So, let’s take an office collecting $100,000 a month with a 22.5% payroll or $22,500 a month. Between raises for existing staff and the higher starting wages for new staff, this doctor increases wages by 5%. So, instead of paying $22,500 a month, he or she is now paying $23,625 a month, an $1,125 increase.

The problem: no additional employees that might increase revenues were hired. Instead, we’re replacing a Hygienist and giving a few people a raise to keep up with the going rate in the market. So, revenues stay the same $100,000. We now run at 23.625% in payroll, which may not seem like a big deal, until you add in the additional costs for marketing (pay-per-click costs and postage went up), electricity, etc. Before you know it, your overhead’s up by 5-10%.

And where does this money come from? You.

So, you’re making less personally in a scorching hot inflationary environment.

Not. A. Good. Thing.

Using our payroll example above, if we wanted to keep our percentages in order, this doctor when increasing wages by 5%, would also have to increase revenues by 5% – and here’s the kicker – without increasing costs.

What To Do

So, how do we accomplish this magic trick of increasing revenues without increasing costs?

Well, I have a few ideas…

Maximize Case Acceptance:

To begin, you should maximize case acceptance. If your treatment presentation skills were top-notch, that 20 minutes you spent presenting 6 crowns, (only to have the patient accept the two insurance would pay for), would result in the patient accepting all six. More effective treatment acceptance = higher revenues, profitability, and most importantly healthier patients doing all of the treatment they need. You can find out more about this at the MGE Communication & Sales Seminars.

Beyond this, (really with this – especially now), if you want to increase revenues without increasing costs, you’re going to need to raise your fees.

Raise Your Fees:

In years past, we’d always roll out the “time to raise your fees” talk sometime in November to track along with the 2-3% (or less) inflation that had happened over the past year. And some clients did and some didn’t and it was fine.

Well, this isn’t years past.

If you talk to Sabri, our Deputy COO, she’s recommending clients do an immediate 10% fee increase. And if you find 10% too overwhelming in one bite, do 3+% every other month for the next six months (10%, but at a more graduated pace).

So, again, while this was a suggestion in years past. I’d say it’s more urgent than ever now. If you don’t, you’ll face two choices:

- Watch your profit evaporate and costs go up (and keep in mind you’ll be making less profit in an inflationary environment) or

- Price yourself out of staying competitive in the labor market and with your marketing. As wages as costs go up, if you can’t go up with them, you’ll lose personnel and end up doing less marketing for what you’re spending now.

So, yeah – time to raise fees. And if you want help or guidance with this, we’re more than happy to assist. Contact us or you can also email me at jeffb@mgeonline.com and I’ll get you connected with someone who can help.

But Jeff, you say, “I would love to raise fees – but the plans I participate with won’t allow me to! 50% of my patients are in plans!”

This is a big deal, which is why I left it to the end.

Re-evaluate Your Insurance Plans:

While inflation has been raging, what are insurance companies doing with in-network providers? Increase reimbursements and their fee schedules, right?

Nope…just kidding…the opposite!

While we don’t have hard stats on this, we have heard from a number of newer in-network clients that several insurance companies are LOWERING reimbursements right now.

So, costs are up, and insurance companies are trying to pay providers less. Yeah…real nice.

So, if 50% of your patients are in-network and you raise fees, you’re really just penalizing your full-fee patients. Not that you shouldn’t raise your fees, but you really need to do something about these insurance plans.

Like…get out of them.

At our MGE Communication and Sales Seminars, I often survey new clients as to what percentage of their patients in a plan would leave the practice if they dropped that plan.

The usual answers: between “50-80%.” In other words, these clients think that if they dropped a plan, 50-80% of the patients would leave.

Score one for insurance company marketing. Because in reality, the numbers are just not that high.

We’ve looked at this for a while, as many of our clients have stopped participating in all plans and are completely fee-for-service. Some still accept assignment – but the patient is charged the normal full fee.

What have we found? Well, on average, a dentist will lose 30% of their patients from a PPO plan when they drop it.

So, if you have 1,000 patients in a plan, and you drop it, the average doctor loses 300 of these patients. 700 of them stay with the practice and pay your normal full fee.

Of course, there are right and wrong ways to do this, and we can walk you through this. And this does NOT apply to HMO plans. The fallout there is worse, and I’d hope you’re not in any of these. And for the most part, PPOs are the problem. PPO infiltration into dentistry is more widespread than HMOs are.

Now, let’s apply the 70/30% concept to some real numbers.

You have three patients in a plan, and they all need a crown. Your PPO crown fee is $800 (not uncommon). Your FULL/normal crown fee is $1,400.

You do three crowns on three PPO patients and it’s $800 X 3 = $2,400.

Now, let’s say you drop the PPO. One of the three patients leave the practice, (33%), which is higher than the normal 30%.

You now do two crowns at full fee on the remaining two patients: $1,400 X 2 = $2,800.

So, for doing one less crown at full fee, you make an additional $400!

And that’s not all, your labor, material, and lab costs are also lower.

Do you see where all this is going?

Now, if you want to see how your practice is being affected by PPO’s I recommend that you go to our site www.raisemyfees.com and set up to have one of our consultants run it through our plan analyzer. It will help to determine how much you’re losing, along with how many new patients you’d need if you dropped that plan.

Summary

We’re in an inflationary environment right now. To keep your practice competitive, you’re going to need to raise revenues without massive costs increases. To that end, I hope all of this helped. If you have any questions, feel free to contact me at jeffb@mgeonline.com.

No Comments

Be the first to start a conversation